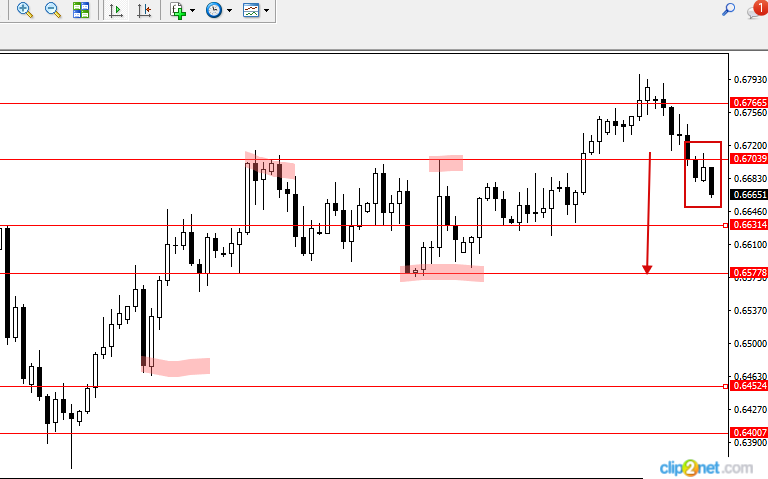

AUD/USD

Analysis Framework - Market Condition , Level , Confluence and Signal .

Strategies- Price Actions Trading

AUD/USD -Market Condition- Short term Bearish Rally - The pairs has been in a major bullish trend for a long time , rally up to 0.67920 resistance region..

Key Level/Support & Resistance- Support has turned to resistance after a bearish move away from 0.67920 region .

Price Action- Pin Bar formed just below the key support - 0.6703

Anticipation- We are anticipating a short term bearish rally to the key support region between 0.66314-0.65778 zone.

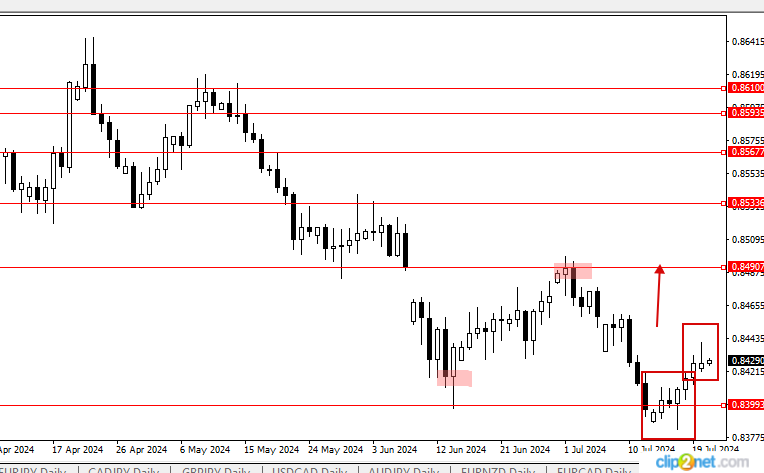

EUR/GBP

Analysis Framework - Market Condition , Level , Confluence and Signal .

Strategies- Price Actions Trading

EUR/GBP market Condition- Bearish trend has been established for some months now, the market is in a correctional mode now after forming a bullish reversal bar at key support area, 0.83993

Key Level/Support & Resistance- 0.83993, .0.84907,

Price Action- Pin Bar formed just below the key support - 0.83993, also bearish reversal pinbar was also formed on friday last week.We consider this as a bearish trap.

Anticipation- We are anticipating a short term bullish rally. to 0.84907 resistance area, where will can look out for a bearish signal to continue the bearish trend.

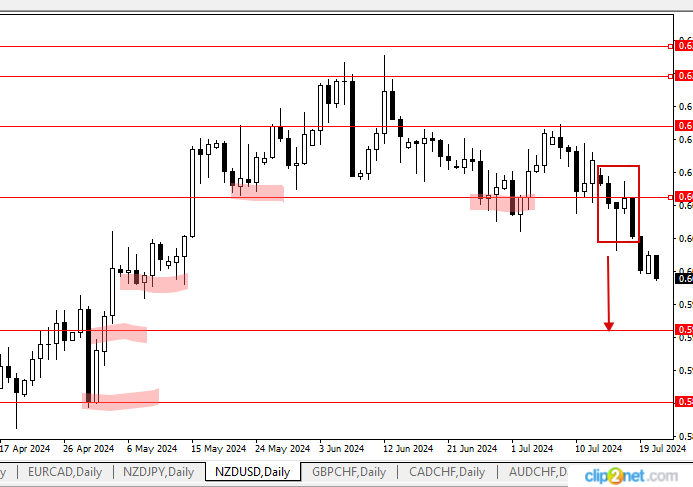

NZD/USD

Analysis Framework - Market Condition , Level , Confluence and Signal .

Strategies- Price Actions Trading

NZD/USD market Condition- Short term Bearish Rally - The pairs has been in a bullish trend .recently.. A short term bearish is under way with the formation of bearish pinbar at a key resistance area, 0.60807

Key Level/Support & Resistance- 0.59490, .0.60807,

Price Action- Pin Bar formed just below the key support - 0.59490.

Anticipation- We are anticipating a short term bearish rally. into key suppoer zone area 0.59490.